Part 2 of the PwC series Succeeding through M&A in uncertain economic times

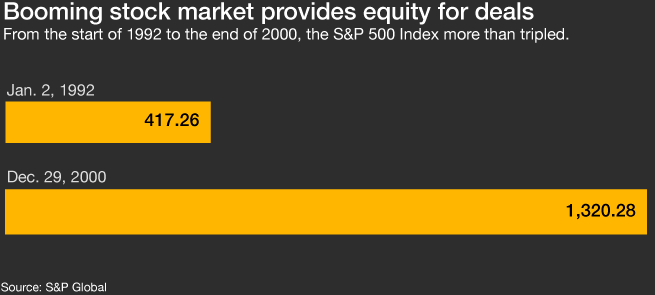

Just as the economy rises and falls in cycles, so have the volume and value of mergers and acquisitions in the US. And as the economic expansion that began in mid-2009 remained resilient for more than a decade – becoming the longest since before the US Civil War, according to federal data – M&A achieved new heights. The uptick in deals activity in recent years was the third such wave in the last three decades, and it lasted longer than each of the previous two.

PwC analyzed data on mergers, acquisitions, leveraged buyouts, minority stake purchases and other investments announced by US acquirers from 1990 through 2018. This analysis is important for understanding how M&A volume and value have behaved historically, as some cyclical trends could endure.

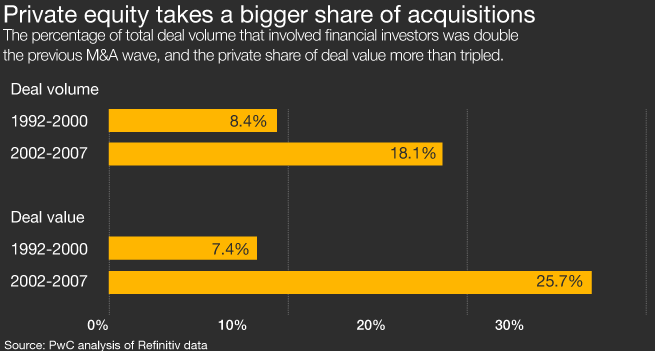

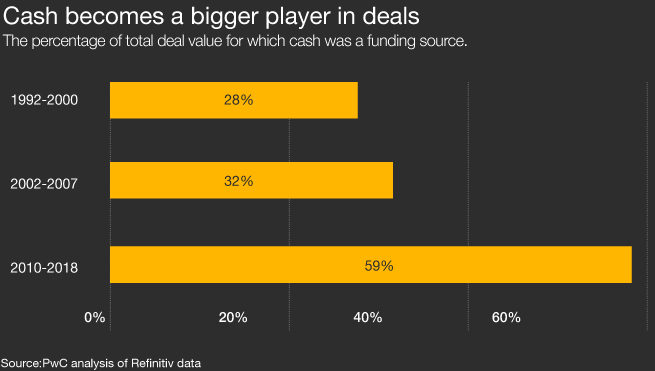

But M&A also is seeing significant structural changes. These include an unprecedented amount of capital and diversity of funding sources for deals. They also include deal strategies that have shifted more capital investment toward emerging technology as the Fourth Industrial Revolution (4IR) continues to unfold. These changes are key to our view that the next M&A cycle will be different, especially as the economy ebbs.

What happened in recent M&A waves

In a typical M&A cycle, deal volumes and values initially decline in line with an economic downturn, often prompted by an exogenous event. Company management and boards of directors often hesitate on big investments, wary of extending their organizations in a weaker economy.

As companies, private equity (PE) firms and other investors reassess portfolios and strategies, the appetite to buy starts to grow as others decide to sell. Lower valuations for targets during the cycle improve the chances for acquirers to see higher returns. With a greater supply of targets, M&A activity accelerates. This momentum eventually slows as more companies regain confidence and economic footing and valuations again climb, reducing the number of acquisition targets and the prospects of strong returns.

As this trend played out in recent M&A waves, the sectors that have seen brisk deal activity have varied, and the funding for deals has shifted over time, especially as the combined wealth in the world has grown.

How companies that made deals during downturns have fared

Between M&A surges, companies still made deals, with many likely eyeing long-term growth. For deals with available data, PwC analyzed public companies’ shareholder returns following their transactions during the last two recessions – how their stock prices changed from the day before the transaction was announced. We then compared those changes to the percent change in the S&P 1500 sector index for each acquirer’s sector over the same periods. Deals aren’t the only factor in shareholder returns, but measuring an acquirer against its industry mitigates factors that affect the industry as a whole.

Our analysis found that companies that acquire in a downturn can see benefits. In the recession from March to November 2001, marked by the dot-com bust, the median shareholder returns for companies that made acquisitions outpaced their respective industries in the following months, rising as high as 7% one year after the transaction was announced. More than 900 companies made 1,600-plus deals during that recession. In several sectors – including consumer durables, insurance, media and entertainment, and healthcare equipment – the median returns for those acquirers after a year were higher than the overall sector by double digits, our analysis found.

Why deals could continue, with positive returns possible

The buying power for potential deals isn’t spread across all businesses and sectors. The largest companies generally control the most cash and are best positioned to maintain the pace of deal activity. Some firms will be more stable in the downturn, others still will struggle. The latter could boost the supply of targets, with divestitures occurring as companies recalibrate – similar to previous downturns. Historically, company valuations have been lower in recessions.

The difference from past cycles will be demand, thanks to the strong capital position that will keep the valuations of sturdier companies from tumbling. Some management teams still might hesitate; previous downturns saw weaker CEO confidence, and a recession after a historically long expansion naturally could bring pause. But the next part of Succeeding through M&A in uncertain economic times explains the unprecedented amount and mix of capital that have increased the ability to do deals in a downturn and set a path for M&A to remain active as the economy slows.

This part of the series has been updated since its original publication in October 2019.

Contact us